Press

News

“Boldness in Business is the first, second, and third thing”

Thomas Fuller

Outstanding

News

This section includes publications related to Jebsen & Co. and/or its team members, as well as newspaper articles published abroad which make reference to the Argentine reality.

Flexibilization of access to the foreign exchange market - July 2024

By means of Communications “A” 8073 and 8074 dated July 23, 2024, the Argentine Central Bank (‘BCRA’) introduced several amendments to make the current foreign exchange regulations more flexible.

In this regard, BCRA modified the current scheme of access to the foreign exchange market for the payment of imports of goods (through 4 payments equivalent -each one of them- to 25% of the FOB value of the goods at 30, 60, 90 and 120 calendar days as from the customs entry of the goods), providing that the access to the foreign exchange market for payment shall be available as follows: 50% of the FOB value at 30 calendar days and 50% of the FOB value at 60 calendar days, in both cases counted from the customs entry of the goods. Likewise, BCRA modified the term of access to the foreign exchange market for the payment of imports of luxury goods and finished automobiles, reducing it from 120 to 90 calendar days as from the customs entry of the goods. Both modifications are applicable for imports performed as from August 1, 2024.

It is worth noting that these provisions do not modify the term of access to the foreign exchange market for the payment of imports of goods performed by individuals and legal entities classified as micro, small or medium-sized enterprises (MSMEs), which continues to be 30 calendar days as from the customs entry of the goods, as established by BCRA on April 11, 2024 through Communication “A” 7990.

On the other hand, regarding the collection of exports of services by individuals residing in the country, BCRA doubled the maximum annual amount that is exempted from the obligation of mandatory conversion into local currency through the foreign exchange market to the extent that it is credited to a local bank account in foreign currency, setting it at USD 24,000.

Last, BCRA lifted the restrictions that prevented individuals who had received certain state aid during the emergency period due to the Covid-19 virus pandemic or who were beneficiaries of subsidies on natural gas and/or electric power supply tariffs from carrying out transactions with securities and other assets (MEP dollar or “blue chip swap”).

Incentive Regime for Large Investments - July 2024

Law 27,742 (known as the ‘Law of Bases and Starting Points for the Freedom of Argentines’ and published in the Official Gazette on July 8, 2024) created the Incentive Regime for Large Investments (‘RIGI’, which in Spanish stands for Régimen de Incentivo para Grandes Inversiones) with the purpose of promoting investment in long-term productive projects, which foresees significant tax incentives and a tax, customs, exchange and regulatory stability regime for a term of 30 years as from the date of adhesion to RIGI.

RIGI is intended for ‘Large Investments’ in projects in the forestry, tourism, infrastructure, mining, technology, iron and steel, energy, oil and gas sectors, and Single Project Vehicles (‘VPU’, which in Spanish stands for Vehículos de Proyecto Único) owning one or more stages of a project of the afore-mentioned nature may apply to RIGI. Besides VPUs, suppliers of goods and services that meet certain requirements may register in RIGI exclusively to be able to import goods exempted from import duties for the provision of goods and services to VPUs adhered to RIGI. Term to adhere to RIGI is two years (counted as from July 9, 2024) and may be extended for one more year by decision of the Federal Executive Branch.

‘Large Investments’ are considered to be those projects in the above-mentioned sectors that meet the following characteristics:

(i) Long-term nature: this requirement is considered to be met as long as investments have a ratio of no more than 30% between, on one hand, the present value of the expected net cash flow (excluding investments) during the first 3 years as from the first capital disbursement and, on the other hand, the net present value of the capital investments planned during the same period (such ratio may be modified by the Federal Executive Branch);

(ii) Minimum investment in computable assets equal to or greater than USD 200,000,000: such minimum investment must be entirely made within a reasonable term to be proposed by the VPU when applying for RIGI (minimum investment amount may be increased up to USD 900,000,000 by the Federal Executive Branch, considering the sector, subsector or productive stage involved);

(iii) Partial performance of minimum investment in the first 2 years as from the date of adhesion to RIGI: it must be no less than 40% of the minimum investment amount, which may be reduced up to 20% by the Federal Executive Branch.

To the extent that the VPU is admitted to RIGI, it may compute -for the purpose of complying with the minimum investment amount- the investments made since the effective date of RIGI (July 9, 2024) even if they are prior to the admission of the VPU to RIGI.

When applying for RIGI, the VPU must submit, among other requirements, an investment plan specifying the total investment amount, execution schedule, sources of financing, direct and indirect employment, local supplier development plan (VPU commits to hire local suppliers for 20% of the total investment amount, provided that the offer is available and under market conditions in terms of price and quality), estimation of production and exports, and technical, economic and financial feasibility.

The main incentives provided by RIGI consist of:

(i) Reduced corporate income tax rate (25%);

(ii) Accelerated amortization of capital investments;

(iii) Transfer of accumulated tax losses with no time limit and possibility of transferring tax losses to third parties after 5 years have elapsed;

(iv) Restatement of tax loss carryforwards based on the variation of the internal wholesale price index (IPIM);

(v) Reduction to 3.5% of withholding tax applicable to dividends and profits derived from the VPU during the first seven years (counted from the date of adhesion to RIGI);

(vi) VAT tax credit certificate system to cancel VAT obligations;

(vii) Use of 100% of the tax on bank debits and credits as income tax credit;

(viii) Inapplicability of the limitations to the deduction of interest and exchange differences related to the financing of the project during the first 5 years (counted from the date of adhesion to RIGI);

(ix) Exemption from import duties and customs taxes on definitive or temporary imports of new capital goods, spare parts, parts, components and inputs;

(x) Exemption from export duties for definitive exports made after the third year of registration in RIGI;

(xi) Exception from the obligation of foreign currency transfer and conversion through the foreign exchange market with respect to the collection of exports of goods (20% in the first 2 years as from the start-up of the VPU, 40% after 3 years and 100% as from the fourth year);

(xii) Exception from the obligation of foreign currency transfer and conversion through the foreign exchange market with respect to capital contributions, loans and services;

(xiii) Free availability of foreign currency not subject to the obligation of transfer and conversion through the foreign exchange market;

(xiv) Inapplicability of limitations to holdings of liquid or non-liquid foreign assets;

(xv) Inapplicability of restrictions or prior authorizations to access the foreign exchange market for the payment of principal of loans and other financial indebtedness with foreign countries and the repatriation of direct investments of non-resident subjects, under certain conditions; and

(xvi) Inapplicability of restrictions or prior authorizations to access the foreign exchange market to pay profits and dividends, or interest.

There are certain additional requirements and incentives for VPUs that are holders of projects that qualify as long-term strategic export projects.

Finally, RIGI also guarantees VPUs regulatory stability in tax, customs and foreign exchange matters for 30 years, which means that the incentives granted cannot be affected by the repeal of the law or by the creation of tax, customs or foreign exchange regulations that are more burdensome or restrictive than those contemplated in RIGI.

Tax stability means that new taxes created as from the date of adhesion of the VPU to RIGI, as well as the increase of existing taxes, will not be applied to the VPU; however, the VPU may benefit from the elimination of taxes or reduction of tax rates that may be established in the future and that may be more favorable. Tax stability does not comprise VAT and social security contributions. Based on the tax stability, if the VPU pays an amount that does not correspond, VPU will be entitled to use it as a tax credit for the cancellation of any national taxes. In turn, if a VPU invokes the violation of tax stability as a consequence of the creation or increase of a new tax or of a legal or regulatory modification of any aspect related to the taxes in force as of the date of accession, the tax authority must justify and prove that such increase has not occurred as a precondition to apply such tax or the higher rate to the VPU.

It is important to mention that the law provides that disputes arising in connection with compliance with the incentives, stability and applicable regime may be submitted to international arbitration.

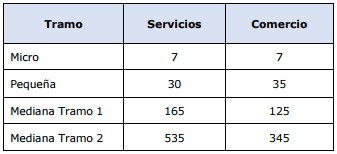

Update of Criteria to Qualify as MSMEs - April 2024

By means of Resolution No. 30/2024 published in the Official Gazette on April 3, 2024, the Secretariat of Industry and Productive Development (National Ministry of Economy) updated the total annual sales thresholds used as parameters to qualify as Micro, Small and Medium-Sized Enterprises (MSMEs).

The new total annual sales thresholds are as follows:

The regulation is in force as from April 1, 2024 and replaced the amounts that had been previously established in March 2023 through Regulation No. 88/2023 of the Undersecretariat for Small and Medium-Sized Companies (National Ministry of Economy), increasing them by the following percentage values per economy sector: construction 164,84%, services 148,29%, trade 181,25%, industry and mining 189,38% and agriculture and livestock 248,21%.

In terms of the number of employees considered to qualify as MSMEs, the new provision continues applying the current table, as follows:

Finally, the assets threshold in force (ARS 193.000.000), remains unchanged.

Easing of the Access of MSMEs to the Official Foreign Exchange Market - April 2024

By means of Communication ‘A’ 7990 dated April 11, 2024, the Central Bank of Argentina (‘BCRA’) provided that individuals and legal entities classified as micro, small or medium-sized enterprises (MSMEs) may access the foreign exchange market to pay imports declared as from April 15, 2024 as from 30 calendar days from the date of registration of customs entry of the goods. Until the enactment of this regulation, MSMEs could cancel imports declared as from December 13, 2023 under the scheme of 4 payments of 25% at 30, 60, 90 and 120 calendar days from the registration of the customs entry of the goods.

Likewise, BCRA enabled individuals and legal entities that qualify as MSMEs to perform through the foreign exchange market payments in advance for the purchase of capital goods for up to 20% of the FOB value of the goods to be imported.

Access to the official foreign exchange market for MSMEs - January 2024

By means of Communication ‘A’ 7952 dated January 25, 2024, the Central Bank of Argentina (‘BCRA’) provided that, as from February 10, 2024, entities that qualify as MSMEs (micro, small and medium-sized enterprises) shall access the official foreign exchange market for the payment of debts for imports of goods and services prior to December 13, 2023.

For such purposes, the aforementioned entities must comply with the following conditions:

- Have debts for imports of goods and services prior to December 13, 2023 whose total amount does not exceed USD 500,000.

- Have registered all their debts for imports of goods and services in the Register of Commercial Debt for Imports with Foreign Suppliers; and

- Have declared the liabilities in the last due return of the Survey of external assets and liabilities (Communication ‘A’ 6401 of the BCRA).

Access to the official foreign exchange market under these provisions will be granted gradually with the following limits: until March 9, 2024 for an amount not exceeding USD 50,000.- and until April 9, 2024 for an amount not exceeding USD 150,000.- For the purposes of these amounts calculation, transactions carried out in all the entities authorized to operate in foreign exchange market and for all the items declared must be considered. According to the joint press release issued by the BCRA and the Ministry of Economy, the remaining amount of the debts of these subjects (above the amounts indicated above) shall be cancelled through the official foreign exchange market as from April 10, 2024.

Should you have any inquiry about this issue, please do not hesitate to contact us at

Communication "A" 7925 of the Argentine Central Bank - December 2023

On December 22, 2023, the Argentine Central Bank (‘BCRA’) issued Communication “A” 7925, effective as of that date.

This Communication establishes the requirements for importers who have outstanding debts with abroad originated in the import of goods with Customs entry registration until December 12, 2023 and/or for services effectively rendered and/or accrued until that date, may subscribe “Bonds for the Rebuilding of a Free Argentina” (“BOPREAL”, by its Spanish acronym).

The main aspects are as follows:

- Importers of goods may subscribe the BOPREALs for up to the amount of the outstanding debt for their imports of goods with Customs entry registration up to and including December 12, 2023.

- The amount of the BOPREALs that importers may subscribe will be limited to the outstanding amount registered in the BCRA’s system for the Follow-up of Payments of Imports of Goods (“SEPAIMPO”, by its Spanish acronym).

- Importers of services accrued up to December 12, 2023 may subscribe BOPREALs for up to the amount of the outstanding debt.

- Importers of goods and services who, prior to December 31, 2023 subscribe to the series maturing in 2027, and for an amount equal to or greater than 50% of the outstanding amount of the import debt, may access the foreign exchange market as from February 1, 2024 to pay import debts for an amount equal to 5% of the amount subscribed.

- Access to the foreign exchange market is authorized for the payment of import debts by means of an exchange and/or arbitration with funds deposited in a local bank account and derived from the collection of BOPREALs’ principal and interest in foreign currency.

- Importers subscribing to BOPREAL may sell them with settlement in foreign currency in Argentina or abroad or transfer them to foreign custodians for up to the amount acquired in the initial subscription without limiting their ability to access the foreign exchange market.

Modifications in foreign trade regulations - December 2023

By means of the Joint General Resolution No. 5466/2023 published in the Official Gazette on December 26, 2023, the Federal Tax Bureau (‘AFIP’) and the National Secretariat of Trade established the creation of the Statistical System of Imports (‘SEDI’) and the Register of Commercial Debt for Imports with Foreign Suppliers (‘Register’).

SEDI is a statistical system through which importers must provide, as a sworn statement, certain information on imports prior to their declaration with the customs authority.

Once the declaration has been made through the SEDI, AFIP will analyze the importer’s tax situation and economic-financial capacity and, if such controls are successfully passed, declaration will become ‘officialized’; otherwise, that is, if any inconsistency is detected, AFIP will notify the importer so that it may amend it and file a new declaration.

At the same time, declaration will become in ‘exit’ status as long as it is authorized by the agencies of the national regime of the Argentine Foreign Trade Unique Counter, which must issue a decision within a term not exceeding 30 calendar days or, otherwise, the declaration will automatically go to ‘exit’ status. The declaration in ‘exit’ status has a term of validity of 360 calendar days.

It is important to note that the goods declared under the SEDI declaration will have a tolerance in the FOB unit value of 7% more or less and in the quantity of 7% more.

Finally, it is worth mentioning that SEDI replaces the former Import System of the Argentine Republic (‘SIRA’) and the Import System of the Argentine Republic and Payment of Services Abroad (‘SIRASE’). Declarations duly filed through SIRA that are in ‘exit’ or ‘cancelled’ status remain in force, while the remaining ones will have no effect and may be registered again through SEDI. Likewise, declarations made through SIRASE that are not approved will have no further effect.

With respect to the Register, the above-mentioned regulation establishes that importers having commercial debt for imports of goods with an officialization date prior to December 13, 2023 and/or services must be registered in the Register. Those who have been able to cancel debt with foreign suppliers through other mechanisms that do not imply any transfer of foreign currency may also register in the Register, thus the total compliance with the payment obligations associated to such operations will be recorded.

The peremptory term to register the debt in the Register will expire on January 11, 2024 and those who do not comply with it will not be able to access to SEDI mechanism and eventually subscribe the Bonds for the Reconstruction of a Free Argentina (‘BOPREAL’) and the debt will be subject to a further evaluation.

Likewise, by means of Resolution No. 1/2023 and with the purpose of simplifying the processing of import operations and in line with SEDI implementation, the National Secretariat of Trade revoked the regulation that required automatic import licenses for all those tariff positions that were not covered by the obligation of obtaining a non-automatic import licenses.

These provisions will enter into force on December 27, 2023.

Deregulation of the economy and public sector reform. Decree 70/2023 - December 2023

On December 21, 2023, Decree 70/2023 ‘Bases for the Reconstruction Argentina’s Economy’ was published in the Official Gazette.

This Emergency Decree issued by the Federal Executive Branch establishes the initial measures for the deregulation of the economy and the reform of the public sector and introduces amendments to several regulations, mainly in the areas of labor, foreign trade, air transport, foreign currency obligations, leases, health, communication services, corporate regime, tourism and vehicles registration, which are summarized below.

The Decree will become effective on December 29, 2023, notwithstanding the fact that it must be submitted to the Federal Congress pursuant to the provisions of the National Constitution.

I) Declaration of emergency

A public emergency is declared with respect to matters related to economic, financial, tax, administrative, social security, tariff, health and social issues until December 31, 2025.

II) Economic deregulation

The following laws, among others, are revoked: Trade Promotion, Price Monitoring, Shelves, Undersupply, Buy Argentine, and the declaration of public interest of cellulose pulp and newsprint.

In addition, the regulation that required that judicial deposits of national courts be made at Banco de la Nación Argentina was overridden and several amendments were made to the credit cards and warrants laws.

III) Public sector reform

The laws on mixed economy companies, operation of state-owned companies, state-owned companies, “Buy National” and the law that establishes the basis for the fixing of retired and pensioners’ salaries are abolished. Likewise, several amendments were introduced to the Public Sector Reform Law regarding the declaration of entities subject to privatization, elimination of the impossibility to declare Banco de la Nación Argentina subject to privatization, elimination regarding the obligation of the programs of joint ownership of entities to be privatized to issue profit-sharing bonds in favor of their personnel, elimination of the rule that allowed granting tax benefits to the company to be privatized and transformation of State-owned companies into corporations within a maximum term of 180 days, among other measures.

IV) Labor regulations

Amendments are introduced to the Labor Contract Law, Collective Bargaining Agreements, the National Employment Law, Trade Union Associations, the Agrarian Labor Regime, the Commercial Traveler’s Regime and the Teleworking Law.

Contracts for works, services, agency and all those regulated by the National Civil and Commercial Code are expressly excluded from the scope of the employment contract and the guiding principle of labor law on the prevalence of the rule most favorable to the employee and the principle of the assumption of the existence of the employment contract are mitigated.

In the case of interposition of personnel recruitment companies, it is established that the workers will be considered direct employees of whoever registers the labor relationship, even if such workers have been hired to work for third party companies.

Labor certificate compliance method is made more flexible and the fine applicable in case of non-delivery or late delivery is eliminated. Moreover, the method for the payment of salaries and the requirements of the pay receipts are made more flexible and it is now possible to keep receipts and proofs of payment in digital format.

The trial period is extended to eight months and the obligation to register the employee at the beginning of the trial period is eliminated. Regarding maternity leave, it is established that the pregnant employee may choose to reduce the pre-birth leave up to 10 days (currently it is 30 days).

The employee’s explicit consent is required to deduct the payment of dues, assessments or periodic contributions resulting from legal or conventional regulations or from being a member of unions, mutual benefit associations or cooperatives.

Participation in blockades or takeovers of establishments is considered a serious offense constituting just cause for dismissal, and an aggravated indemnity is provided for when the dismissal is motivated by discriminatory acts.

13th monthly salary and items paid semiannually or annually (bonus) are excluded from severance payment calculation base and calculation for workers paid on commission is also modified.

Collective bargaining agreements may replace the severance payment system with a severance fund or system, and employers are allowed to contract a private capitalization system to pay severance payments.

It is foreseen that labor credits will be restated based on the historical principal updated by the Consumer Price Index variation plus a pure interest rate of 3% per annum. As for the payment to be made regarding labor lawsuits, employers covered by the law on SMEs will be able to make full payment in up to twelve consecutive monthly installments, adjusted by the Consumer Price Index variation plus a pure interest rate of 3% per annum.

Regarding the teleworking regime, the care of minors, disabled or elderly people living with the worker must be coordinated with the employer as long as they do not affect the requirements of their job and that this benefit will not be granted if the employer pays a compensatory amount, the reversibility to face-to-face work will require the agreement of both parties and provided that the conditions exist in the employer’s facilities, the requirements of prior authorization from the Ministry of Labor for transnational services are eliminated and the simplification of the teleworking registry is provided for.

V) Foreign trade

Several amendments are introduced to the Customs Code, mainly regarding the possibility for individuals and legal entities to manage customs clearances without the need to hire a customs agent, elimination of the need to register in the Customs Register of Importers and Exporters for imports and exports, digitalization of Customs procedures, in the event of a complaint of customs offenses the Customs Office will not be able to withhold a customs clearance until the complaint is processed if the declarant provides a guarantee, modifications to the customs litigation procedure, the prohibitions of an economic nature must be established by a law issued by the Federal Congress (those of a non-economic nature may be established by the Executive Branch) and a procedure for early consultation on a specific matter and with binding effects for the customs service must be established.

The law prohibiting the importation of retreaded and used tires is eliminated.

VI) Bioeconomy and energy

The following laws are abolished: Rural Lands, Viticulture, Sugar deliveries for consumption in the domestic market, National Viticulture Policy, Industrial Promotion, Viticulture Reconversion, Yerba Mate Packaging at Origin Regime, National Corporation of Olive Growing, Packaging for livestock feed products, Integral Policy for cotton, National Mining Trade System, National Mining Information Bank and Federal Plan of Electric Energy Transportation, and the law that regulates the operation of the National Yerba Mate Institute is amended.

Furthermore, the decrees that established the maximum duration terms for exclusive fuel supply contracts and regulated the extensions of high voltage electric power transmission and trunk distribution, among other regulations, are also derogated.

The National Secretariat of Energy is empowered to redetermine the structure of current subsidies to end users of electric power and natural gas.

VII) Air transport

Several law amendments are introduced in order to implement an “open skies” policy, which mainly affect the Aeronautical Code, the aerocommercial transportation law and the decree declaring an emergency in aerocommercial matters.

Additionally, the partial or total assignment of the shares of Aerolíneas Argentinas S.A. and Austral Líneas Aéreas – Cielos del Sur S.A. and its controlled companies to their employees is authorized in accordance with the equity ownership program.

VIII) Contractual obligations

Amendments are introduced to the Civil and Commercial Code to establish that obligations to give money must be paid in the agreed currency (whether or not it is legal tender in the country), which cannot be modified even by judges, and the principle of freedom of the parties is reinforced.

In addition, the Lease Law is abolished and new provisions are introduced in the Civil and Commercial Code, allowing the parties to freely agree on the guarantees and periodicity of payment, the term of the contract (in case of silence, the term of the lease of real estate used for housing is 2 years), the currency of payment and the update index, and the regime of early termination by the tenant is modified.

IX) Health

Amendments are introduced to the law on the use of drugs by generic name, private medicine, social security, the National Health Insurance System, electronic or digital prescriptions and the practice of pharmaceutical activity, among other regulations.

The law that declared the activity of public production laboratories to be of national interest and the decree that limited increases in private medicine fees to a certain percentage of the variation of the average taxable remuneration index of stable workers are revoked.

X) Communication services

Amendments were introduced to the Audiovisual Communication Services Law in order to eliminate the limits to the plurality of licenses at the national level (1 license for audiovisual communication services on satellite support, up to 10 licenses for radio content signal, open television and television broadcasting, and up to 24 licenses for the operation of subscription broadcasting services with physical link in different locations). Limits in force at the local level are maintained, and the rule that established that, in order to obtain or extend the term of a mobile broadcasting license, such licenses could not be accumulated with licenses of other services of a different kind or nature was eliminated. In addition, the Argentina Digital Law was amended to include satellite service within the category of “subscription broadcasting”.

XI) Corporate law

The General Law of Corporations is amended to allow associations and nonprofit entities to form part of corporations and any associative contract.

Concerning the requirements for the transformation, it is added that in the case of the transformation of a civil association into a commercial company or that resolves to become a partner of a corporation, the vote of two thirds of the associates will be required.

XII) Tourism

The laws on commercial establishments in tourist areas or under national tourism promotion plans, travel and tourism agents and timeshare tourism systems are derogated.

XIII) Registry of Motor Vehicle Ownership

Several amendments are introduced to the vehicle legal regime, such as the repeal of the place of domicile of the vehicle and its change, implementation of the title deed in digital format and the possibility of making registrations or annotations directly before the National Direction of the Registry in a remote, open, accessible and standardized manner, implementation of an electronic and public access registry (which must be in force no later than May 2, 2024) and the possibility of making requests for registrations or annotations before the Registry in electronic format. Likewise, it is provided that the existence of debts in regular situation for fines or vehicle tax does not prevent the registration or transfer of ownership of motor vehicles.

Payment of Tax and Customs Obligations by means of BCRA Bons or Securities - December 2023

The Necessity and Urgency Decree 72/2023 (the Decree), published in the Official Gazette dated 22 December 2023, established the possibility of canceling tax and customs obligations before the AFIP (tax authorities) by giving in payment certain bonds or securities issued by the Central Bank of the Argentine Republic (BCRA) that are subscribed in U.S. Dollars by legal entities that hold debts for imports of goods with customs entry registration and/or import of services effectively rendered, until 12 December 2023, inclusive.

- Tax and Customs obligations

Bonds or securities issued by the BCRA, for those who have debts for imports of goods with customs entry registration and/or imports of services effectively rendered, up to and including 12 December 2023, may be given in payment for the cancellation of tax and customs obligations, plus interest, fines and accessories, the application, collection and control of which is the responsibility of the AFIP, with the following exceptions:

- Employers’ and employees’ contributions to the Social Security System.

- Contributions to the Social Welfare System.

- Dues corresponding to the Compulsory Life Insurance.

- Contributions to Labor Risks Insurance Companies.

- Tax on Credits and Debits in Bank Accounts and Other Transactions.

- Obligations arising from the substitute or joint and several liability for debts of third parties or from acting as withholding and collection agents.

- Bonds or securities

The bonds or securities will be those issued as from 22 December 2023 and up to and including 31 March 2024, expressly accepted by AFIP for such purpose. Such instruments may be freely transferred by their holders.

- Surrender in lieu of payment

Holders of bonds or securities issued by the BCRA may give them in payment under the terms of the Decree, at their technical value calculated at the applicable exchange rate, according to the terms and conditions stipulated by the AFIP and the BCRA.

The total value of bonds or securities issued, which may be surrendered in lieu of payment of overdue tax and customs obligations, will be limited to USD 3.500.000.000.000, and must be used according to the following schedule:

- A maximum value equivalent to USD 1.000.000.000 from 30 April 2025 to 29 April 2026.

- A maximum value equivalent to USD 1.000.000.000 from 30 April 2026 to 29 April 2027.

- A maximum value equivalent to USD 1.500.000.000 from 30 April 2027 to 31 October 2027.

Such surrender in lieu of payment shall be governed by the provisions of the Decree, which are independent of and not subject to the contractual rules governing the issuance of the respective bonds or securities by the BCRA.

The Decree expressly recognizes that the surrender in lieu of payment of the bonds or securities for the cancellation of tax and customs obligations constitutes an acquired right, both for the subscriber and for any holder of such bonds or securities and, therefore, is part of its property right, which leads to expressly recognize that any restructuring, whether mandatory or voluntary, will not affect its calculation for the purposes of the provisions of this measure.

The surrender in payment of the bonds or securities for the cancellation of such obligations will not be admissible once the BCRA makes the payment of their principal. If the BCRA makes a partial payment of the principal, the aforementioned surrender in payment of the bonds or securities will be valid for the remaining unpaid principal amount.

Once the bonds or securities are surrendered in payment for the cancellation of the obligations, the holder of the surrendered bonds or securities may not make any claim whatsoever to the BCRA.

- Regulation

The Ministry of Economy, the BCRA and the AFIP shall issue the pertinent explanatory and complementary regulations to implement the provisions of the Decree.

- PAIS Tax

The subscription in pesos of bonds or securities issued in U.S. dollars by the BCRA, as determined by the AFIP, by those who have debts for imports of goods with customs entry registration and/or import of services effectively rendered, up to 12 December 2023, inclusive, is subject to the Tax for an Inclusive and Supportive Argentina (PAIS Tax). Such imports must be taxable by the PAIS Tax.

The Tax will be determined on the total amount of the transaction for which the bonds or securities are subscribed. The tax rate shall be 0% until 31 January 2024 and, as from 1 February 2024, it shall be the one applicable to imports of goods with customs entry registration and/or imports of services effectively rendered, up to and including 12 December 2023, for which the bonds or securities are subscribed.

The payment of the tax shall be borne by the subscriber, but the financial entity through which the integration of the subscription is made shall act as collection and liquidation agent. The collection of the tax shall be made at the time the debit of the subscription integration is made.

- Effective date

This Decree will become effective on 22 December 2023, effective for subscriptions of bonds or securities made on or after that date.

Regime to Promote Knowledge Economy - June 2019

Summary

The National Congress approved the so called “Regime to Promote Knowledge Economy” aimed at promoting economic activities using knowledge as well as the digitalization of information and technologies for the purpose of obtaining goods, rendering services and/or to improve processes. The mentioned Regime will become into force from January 1, 2020 until December 31, 2029.

Promoted Activities

The main objective is to promote the creation, development, production and implementation or adaptation of products and services, both in their basic and applied aspects, including those which are produced to be incorporated into processors and/or other technological devices.

In particular, the promoted areas or items are:

- Services, development, implementation and the set-up of software and digital information services;

- Audiovisual and digital production and post-production;

- Biotechnology, bio-economy, biology, biochemistry, microbiology, bio-information technology, molecular biology, neuro-technology and genetic engineering, geo-engineering as well as their tests and analysis;

- Geological and drilling services as well as services related to electronics and communications;

- Export of professional services;

- Nanotechnology and nanoscience;

- Aerospace and satellite industry;

- Engineering for nuclear industry;

- Manufacturing, set-up, maintenance of goods and services oriented to solutions, digital processes and production automatization, such as artificial intelligence, robotics, internet, sensors, etc.

The activities related to engineering, exact and natural sciences, agricultural and livestock sciences as well as medical sciences focused on research tasks and experimental development, are also included among the promoted areas.

Beneficiary Subjects

This promotion regime is intended for legal persons incorporated in Argentina or authorized to act in this country, developing within the national territory, either on their own or as their main activity, some of the activities mentioned hereinbefore.

Besides their due registration at the National Registry of Beneficiaries of the Regime for the Promotion of Knowledge Economy, the beneficiary subjects must comply with at least two of the following requirements:

- Provide evidence of continuous improvements to the quality of their services, products and/or processes, or by means of a well-known quality standard;

- Provide evidence, indistinctly and/or jointly, of expenses incurred on research and development for a minimum of 3% of its total turnover, or on training for the employees involved on the activities referred above for a minimum of 8% of the total salary payroll; or

- Provide evidence on the export of goods and/or services arising from the development of any of the promoted activities, for at least 13% of the total turnover of said activities. If the exports are related to professional services, it will be required, at least, to perform an export exclusively deriving from such activity for 70% of the total turnover (unless in case of a micro or small sized company, in which case it will have to represent 45% of the total turnover for the first 5 fiscal years to be counted from the enforcement of the present promotion regime).

In order to be considered as the main activity, the turnover of the promoted activities must represent at least 70% of the total. Should the beneficiary subject had not yet issued any invoice, it might request its registration by filing a sworn statement and providing evidence that 70% of its personnel are involved in such activity.

Fiscal Benefits

The beneficiaries of this promotion regime are entitled to a fiscal stability in connection with the activities subject to promotion as from the date of their registration at the National Registry of Beneficiaries of the Regime for the Promotion of Knowledge Economy, and therefore their total national tax burden would not be increased at the time of filing the application in the mentioned Registry (in other words, national taxes having as passive subjects the registered beneficiaries, as well as duties or fees to imports and/or exports).

In line with employers’ social security contributions, for each worker under a labor relationship a detraction (reduction) of an amount equivalent to ARS 17,509.20 is established, amount which will be reviewed and updated according to the Consumer’s Price Index. Furthermore, the beneficiaries can obtain a fiscal credit bonus which is transferable only once and equivalent to 1.6 times the amount of the employers’ contributions which would have corresponded to be paid over the amount referred to above, and the same can be applicable to the payment of income tax or VAT. Whenever an employee under an employer-employee relationship holds the title/degree of Doctor, the fiscal credit bonus generated by such employee will be equivalent to two times the employer’s social security contributions which should have been paid over the amount of ARS 17,509.20 (updatable) previously referred to, for the term of 24 months since his/her incorporation.

Regarding income tax, the beneficiaries will be subject to a reduced rate of 15% provided always that the personnel payroll is kept according to the provisions established in the pertinent regulations. Additionally, a credit can also be deducted for taxes actually paid or withheld abroad, whenever referring to income from an Argentine source (up to the limit of the tax obligation increase arisen from the incorporation of such income).

Finally, the beneficiaries will not be subject to VAT withholdings or collections.

Rate Verification, Control and Payment

The application authority may carry out audits, verifications, inspections, controls and/or evaluations aimed at verifying the fulfillment of the liabilities and obligations corresponding to the beneficiaries. These tasks will be settled through the payment of a fee that may not exceed 4% calculated over the amount of the fiscal benefits obtained within the framework of the present promotion regime.

Financing Contribution

Finally, each beneficiary will have to pay, on an annual basis, an amount equivalent to up to 1.5% of the total amount of the fiscal benefits granted, to the Fiduciary Fund for the Development of Enterprising Capital (acronym in Spanish “FONDCE”).

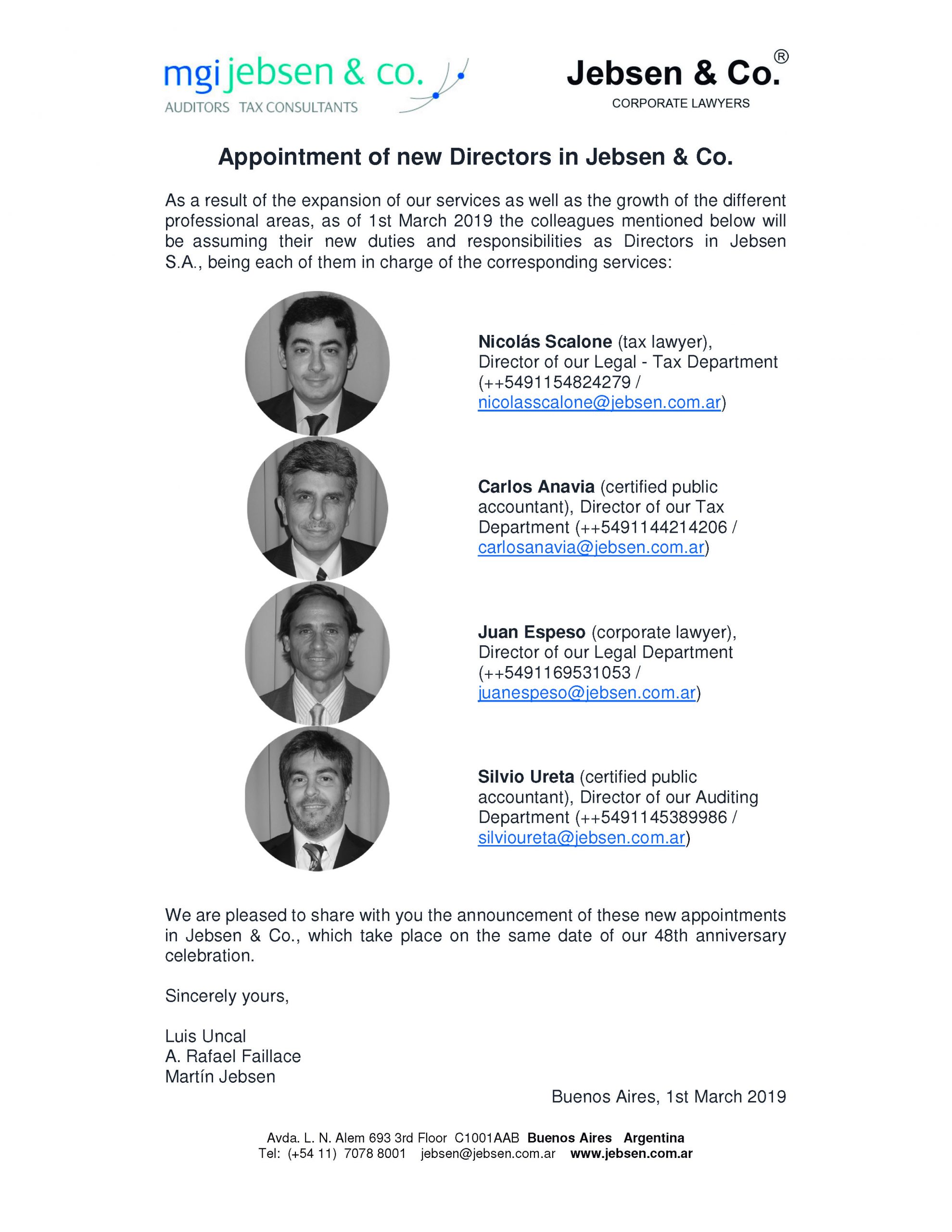

Appointment of new Directors in Jebsen & Co. - March 2019

Taxation in Argentina - March 2019

Corporate Taxation – at a glance

| Tax | Rate % |

| Corporate or Branch Income | 30 |

| Capital Gains | 30 |

| Withholding Tax: | |

| Dividends | 7 |

| Interest | 15.05 / 35 |

| Royalties (patents, trademarks and know-how) | 28 |

| Royalties (copyrights) | 12.25% / 31.5% |

| Royalties (other) | 31.5% |

| Fees (technical) | 21% / 31.5% |

| Fees (management) | 24.5% / 31.5% |

| Branch Remittance |

7 |

The Net Operating Losses can be carried forward for 5 tax periods.

Taxes On Corporate Income and Gains

Corporate Income Tax

Personal Assets Tax

Tax on Debits and Credits in Current Account

Debits and credits in current account are subject to this tax at a 0.6% rate. The 33% of the tax levied on credits can be credited against Income Tax and/or Minimum Presumed Income Tax.

The following operations are considered to replace the use of debits and credits in current account, and therefore they are taxed at an increased rate of 1.2%:

a. Management of the collection of checks, invoices and any other instrument

b. Drafts and transfers carried out via any means

c. Payments on behalf of and/or in the name of a third party

In this case, the 17% of the tax levied on these operations can be credited against Income Tax and/or Minimum Presumed Income Tax.

On the other hand, debits and credits originated in activities carried out by grain brokers, livestock brokers and other intermediaries, are taxed to a reduced rate of 0.075% without right to tax credit.

Turnover Tax

The provinces and the City of Buenos Aires levy this tax on gross revenues derived from the usual practice of economic activities.

Rates vary depending on the type of activity, ranging generally from 1% to 8%. Exportations are generally exempt. Primary and industrial production activities -except for sales to final consumers- can be exempt, under certain conditions.

Stamp Tax

The provinces and the City of Buenos Aires levy this tax on contracts for consideration, which are implemented in writing. Rates vary depending on the type of contract and the jurisdiction in which the same is enforceable, ranging generally from 0.5% to 4%.

Municipal Rates

Each municipality applies rates on services rendered to persons domiciled therein. In general, the rates are calculated in accordance with certain variables (e.g. activity developed, surface occupied and turnover amount).

Other Significant Taxes

|

TAX |

RATE % |

|

Value added tax (IVA) – standard rate |

21 |

|

Value added tax (IVA) – other rates |

5 / 10.5 / 27 |

|

Social security taxes on salaries and wages, paid by the employer |

18 / 20.41 |

|

Local taxes on real estate, etc. |

Various |

|

Export duties on services. |

12%2 |

The importer of goods and services in Argentina is liable for payment of VAT on the value of the goods and services imported, which constitutes in-put VAT for the importer.

There is a permanent regime for the reimbursement of tax credits originated in the purchase, construction, manufacturing or import of fixed assets, which after six consecutive tax periods (months) as from their acquisition are still part of the balance in favor of the taxpayer.

These rates will gradually converge in 19.5% for tax periods beginning as from January 1st, 2022. On the other hand, there is a tax allowance of ARS 7,003.68 per employee, which will gradually increase on an annual basis until 2022.

However, the export duty amount must not exceed ARS 4 per each USD of taxable services.

Treaty Withholding Tax Rates

Argentine’s double taxation treaties, which establish maximum tax rates lower than those under general tax law, are the following:

| Country | Dividends % | Interest % | Royalties % |

| Australia | 10/15 | 0/12 | 10/15 |

| Belgium | 10/15 | 0/12 | 3/5/10/15 |

| Bolivia | (*) | (*) | (*) |

| Brazil | 10/15 | 0/15 | 10/15 |

| Canada | 10/15 | 0/12.5 | 3/5/10/15 |

| Chile | 10/15 | 4/12/15 | 3/10/15 |

| Denmark | 10/15 | 0/12 | 3/5/10/15 |

| Finland | 10/15 | 0/15 | 3/5/10/15 |

| France | 15 | 20 | 18 |

| Germany | 15 | 0/10/15 | 15 |

| Italy | 15 | 0/20 | 10/18 |

| Mexico | 10/15 | 0/12 | 10/15 |

| Netherlands | 10/15 | 0/12 | 3/5/10/15 |

| Norway | 10/15 | 0/12 | 3/5/10/15 |

| Russia | 10/15 | 0/15 | 15 |

| Spain | 10/15 | 0/12 | 3/5/10/15 |

| Sweden | 10/15 | 0/12.5 | 3/5/10/15 |

| Switzerland | 10/15 | 0/12 | 3/5/10/15 |

| United Kingdom | 10/15 | 0/12 | 3/5/10/15 |

(*) Without limit.

Personal Taxation

Income Tax – Employment

Residents are subject to tax on worldwide income. Non-residents are taxed only on Argentine source income.

Individuals of foreign nationality, who have obtained a permanent residence in Argentina or have resided temporarily for 12 months, are considered resident. However, individuals residing in Argentina on work assignments for a period not longer than 5 years are taxed only on their Argentine source income.

Taxable income from employment includes all salaries, regardless of taxpayer’s nationality or the place where the compensation is paid or the contract is entered into. Taxable compensation also includes most employer paid items except employee education expenses and the provision of working clothes and equipment.

The progressive tax rates applied to Argentine taxable residents range from 5% to 35% (depending on the taxable income). Non-residents are taxed at a flat rate of 35%.

When computing tax to be withheld from an employee’s salary, employers are authorized to deduct certain allowable expenses (e.g.: social security contributions, medical insurance payments for employees and their families, medical expenses, cost of home rent, expenses incurred by travelling salesmen based on estimates established by the tax authorities, burial expenses and life insurance premiums).

Other standard deductions are permitted in fixed amounts established by law. Their estimated amounts include a personal deduction of ARS 412,075.14, a personal exemption of ARS 85,848.99, and family allowances equal to ARS 80,033.97 for spouse and ARS 40,361.43 for each child. To qualify, the dependants must reside in Argentina for more than 6 months in the year and must not have income in excess of the amount of the personal exemption.

Income Tax – Self-Employment / Business Income

Residents are subject to tax on their worldwide self-employment and business income. Non-residents are subject to tax on self-employment and business income only from Argentine source.

Self-employment or business income is taxable regardless of the recipient’s nationality, the place of payment, or where the contract was concluded.

The progressive tax rates range from 5% to 35%.

Expenses incurred in producing income are deductible. Certain expenses not primarily incurred for business purposes are deductible as well (e.g.: social security contributions, medical insurance payments for employees and their families, medical expenses, expenses incurred by travelling salesmen based on estimates established by the tax authorities, burial expenses and life insurance premiums).

Other standard deductions are permitted in fixed amounts established by law. Their estimated amounts include a personal deduction of ARS 171,697.97, a personal exemption of ARS 85,848.99, and family allowances equal to ARS 80,033.97 for spouse and ARS 40,361.43 for each child. To qualify, the dependants must reside in Argentina for more than 6 months in the year and must not have income in excess of the amount of the personal exemption.

Director’s fees are taxed as self-employment income. If they are paid by Argentine companies they are considered Argentine source income regardless of where services are performed.

Investment Income

Dividends from Argentine corporations and branch remittances are taxable at a rate of 7% (when paid out of corporate profits subject to the 30% tax rate) or 13% (when paid of corporate profits taxed at the 25% tax rate).

Royalties and income from renting real property are taxed as an ordinary income.

Financial gains are subject to tax, as well as capital gains derived from the sale of shares, values representative of shares and certificates for the deposit of shares and other corporate participations (including quotas of mutual investment funds and certificates of participations in financial trusts and any other right over trusts and similar contracts), digital coins, securities, bonds and othervalues.

Income tax rate is 15% for capital gains or profits derived from investments in foreign currency or with an adjustment clause –exchange differences or capital updates are excluded–, as well as income derived from the sale of shares and similar corporate participations. Applicable rate for capital gains or profits derived from investments in local currency without adjustment clause is 5%.

A deduction of ARS 85,848.99 is allowed for capital gains or profits derived from local investments, except for income from the sale of shares and similar corporate participations.

Income derived from the sale of shares with a quotation negotiated at the local exchange markets is exempt, as well as income derived from operations concerning the public offer of shares carried out according to the provisions set-forth by the National Securities Commission. The exemption is extended to the case of mutual investment funds whose assets are mainly formed by shares (at least at a 75%). These exemptions are applicable to individuals resident in Argentina. They also apply to foreign beneficiaries residing in “cooperative jurisdictions” or whose invested amounts come from such jurisdictions (except for bank notes known as “Lebacs”).

Relief for Losses

Business losses of self-employed individuals may be carried forward for 5 years. Foreign source business losses may offset only foreign source income.

Capital Gains

Capital gains derived from the sale or transfer of shares, bonds and other securities are taxable at a 15% rate. The sale of real estate owned by individuals (except the dwelling house) is subject to tax and the applicable rate and taxable base depend on the purchase date of the property. If it was purchased before January 1st, 2018, real estate transfer tax is levied on the sale price at 1.5% rate; if it was purchased as from that date, income tax applies at a 15% rate on the difference between sale price and updated cost, plus certain expenses.

Personal Assets Tax

Social Security Taxes

Administration

Non-residents Taxation

Double Tax Relief

A tax credit is allowed for income taxes paid abroad, up to the increase in Argentine tax resulting from the inclusion of the foreign source income in the Argentine tax base.

Transfer Pricing

Transactions with related parties

For all transactions with foreign related parties, local companies must show whether prices have been agreed upon according to market values between independent parties, otherwise make the corresponding price adjustment for corporate income tax purposes.

This procedure also applies to transactions carried out with parties organized or located in non-cooperative jurisdictions (as listed by the Executive Branch* ), regardless of whether the parties are related or not.

The definition of “related party” is very large. It includes not only situations of direct or indirect participation in the capital, control or management, but also the exercise of a significant influence over another entity (e.g. exclusive distributor, single supplier, single customer, single client, and company having the exclusive use of technology or assistance).

In general, the following methods are allowed: (i) Comparable Uncontrolled Price; (ii) Resale Price; (iii) Cost Plus; (iv) Profit Split; and (v) Transactional Net Margin.

Reporting Requirements

Tax Department

March 2019

© mgi Jebsen & Co. The information of this publication is not to be construed as an opinion or tax advice and does not imply a comprehensive coverage of all the matters referred to herein.

48th Anniversary - March 2019

1971 – 2019

It is a great pleasure to share with you the first 48 years of life of Jebsen & Co. which we are celebrating on 1st March 2019.

Retrospectively, we can observe long and lasting relationships with our clients as well as the steadiness of our staff members.

Both aspects are the main and essential assets of Jebsen & Co. for which we feel very proud and grateful on this significant date for our professional activity.

We look at the future of our development with optimism and hope to continue sharing the same both with our staff and our clients.

Best regards

Nicolás Scalone, Carlos Anavia, Juan Espeso, Silvio Ureta, Luis Uncal, A. Rafael Faillace, Martin Jebsen

CRONISTA.COM - August 2015

By Dolores Olveira | CRONISTA.COM

Justice has ruled in favour of a company that was able to prove that a money contribution received from its head office overseas was not a simple capital contribution pretending to be a loan in order to accrue interest, and therefore use the expenses to reduce the amounts to be paid as Income Tax, but has instead been a real trade operation.

The Courtroom IV of the Federal Chamber for Contentious Administrative Proceedings, confirmed the final judgement of the National Fiscal Court on the case “Lexmark International de Argentina Inc. Sucursal Argentina” that had revoked an adjustment made by the AFIP (tax authorities) in relation to the deduction of interest and exchange differences concerning unpaid balances in foreign currency due to the purchase of goods to a related company from Uruguay, which the Tax Authorities had considered to be capital contributions.

The AFIP justified that adjustment on the principle of economic reality, re-classifying the importation of inventories as capital contributions in view that the same were operations between related companies, alleging that there existed no term for the cancellation of debts, no interest due to delays in payment, no refinancing agreements signed or special guarantees and, furthermore, there existed no intention for permanence of the funds because the creditors did not expect any reimbursement and had made no claim whatsoever, as explained by Nicolás Scalone, from Jebsen & Co.

The Chamber considered unsatisfactory the evidences produced by the AFIP in order to justify the adjustment made, because it has been duly proved on the case, through accountant’s expert evidence, that the liabilities corresponded to real trade operations and were related to the trade activities of the taxpayer, and that from 2003 to 2007 most of the debt’s total had been cancelled, being this used as a contundent evidence to show the existence of the permanence of funds plead by the AFIP.

Note extracted from: CRONISTA.COM printed edition.

Date: 14 August 2015

HELVETIA MAGAZINE - March 2015

PARTNERS NEWS

COMPANIES INFORM

Since 1987 Jebsen & Co. is a member of mgi, an international alliance that is currently represented by 315 firms in 85 countries. Recently, and during the Annual General Meeting held on October 2014, mgi has announced that within the alliance a new network structure will be created. During said meeting, Luis Uncal, partner of Jebsen & Co., has been appointed as “Risk Partner for the Latin American Area”. This duty implies that he will be the valid spokesman before the remaining areas of mgi and before the International Committee of mgi during the process of quality control implementation. His main activity will be to act as intermediary between the headquarters in London and the Latin American Area, with more than 40 members, on all issues referred to the implementation of the network within mgi, aimed at assuring the fulfillment of the Area’s needs.

www.jebsen.com.ar

Note extracted from: Helvetia Magazine

Date: March 2015

HELVETIA MAGAZINE - June 2013

MGI meeting in Uruguay

The partners of MGI Jebsen & Co., Rafael Faillace, Luis Uncal and Martín Jebsen, have last May attended the Annual Latin American Area Meeting of MGI. They travelled to Montevideo, together with two of their staff members, Ms. Gisela Oddera (accountant) and Mr. Nicolás Scalone (lawyer), to attend this event organized by the uruguayan firm MGI CASU, held at the Sheraton Hotel of Montevideo. It is worth mentioning that Nicolás Scalone, Manager of the Legal – Tax Department of MGI Jebsen & Co., together with his colleague from MGI CASU, the CPA Nicolás May, were invited to made a lecture during said meeting about the issue “TIEA: Tax Information Exchange Agreements”.

Furthermore, Rafael Faillace made a presentation about “Transfer Pricing: working experiences between Latin American Area firms of MGI”.

www.jebsen.com.ar

Note extracted from: Helvetia Magazine

Date: June 2013