Estado de Implementación

«En los negocios prácticos de la vida, no es la fe la que salva, sino la desconfianza»

Napoleón Bonaparte

The global transfer pricing documentation rules

In the public perception international tax issues have never been so much in focus as within the last few years. In order to keep track of transfer pricing documentation requirements worldwide in these turbulent times, Rödl & Partner’s international transfer pricing group offers a bilingual overview of 62 countries with the most important information on documentation requirements and deadlines.

Current challenges of transfer pricing documentation

Events, such as political and military conflicts, the energy crisis, the consequences of the COVID-19 pandemic, have a lasting impact on the global economy. In particular, the accompanying changes to intra-group supply chains and service relationships in internationally active groups of companies have a major impact on transfer pricing for tax purposes. This makes it all the more important to have timely, transparent documentation and sufficient justification of business decisions, which are often due to external influences, in order to justify adjustments in the area of transfer pricing to the tax authorities.More precise and useful information for transfer pricing risk assessments and audits

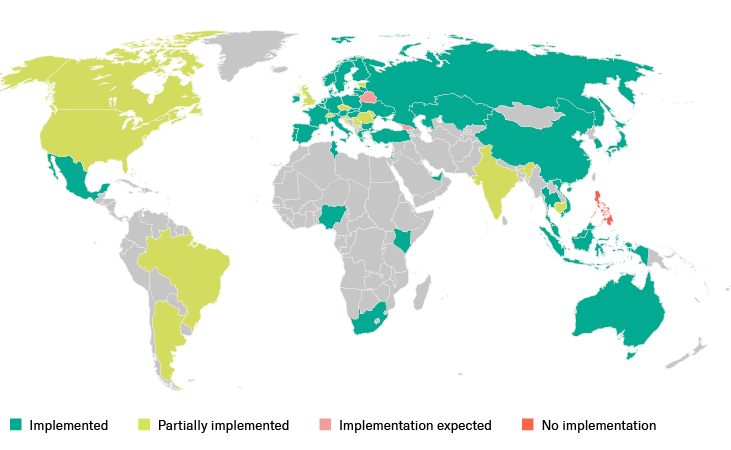

BEPS Action 13 deals with enhancing transparency for tax administrations by providing them with adequate information to assess high-level transfer pricing (“BEPS Action 13: Re-examine Transfer Pricing Documentation”). Nearly ten years after the BEPS Action Plan was published almost all developed countries and many of the so-called developing countries have implemented the three-tiered documentation concept into national law.

National implementation status: OECD Master File Concept and CbC-Reporting

BEPS Action 13 state of implementation in selected countries

International duty to cooperate as important compliance task

In view of the transfer pricing documentation and country-specific reporting obligations regulated on national level, it is hardly surprising that the process of determining individual reporting obligations binding on internationally operating groups will itself take a lot of effort and give rise to uncertainty in some cases. However, knowledge of the implementation status in the respective country is an important compliance task for the transfer pricing management within international corporate groups, in particular in order to avoid formal errors, and thus a first point of criticism regarding the usability of documentation, especially in the course of the increasing transparency of taxation.